It seems like just a few years ago you were in college. You spent any extra money you had on pizza and going out with friends.

But now, you’re 30-something. You have a steady job and maybe even a family. And now you have an incentive to build a solid financial foundation. Retirement is closer than you think, and unexpected expenses can quickly put you in a tough situation. So, how can you get your finances in order easily?

Follow these seven steps to begin building your financial security in your 30s.

1. Invest in Yourself

The most important thing you can do is invest in yourself. Constantly look to learn and develop new skills so that you always keep growing.

That may mean more education, a certificate, or training. You may even find yourself getting a raise, a new position, or a new career altogether because of these new skills.

Make yourself marketable. Even if you’re satisfied with your current career, position, or business, keep moving forward. Continue networking with coworkers, other companies, and other opportunities. You never know when you’ll get a better job offer or be offered an opportunity for advancement.

Finally, do things that build your confidence. Offer to take on new projects that are out of your norm, work with new people, try a new approach, or take up an old favorite hobby. Your confidence level makes a huge difference in how you work, live, and play. Prioritize things in your schedule that make you feel alive.

2. Create a Vision for Your Future

Where will you be financially, personally, and professionally in 20-30 years? Without a vision, you won’t know where you’re going.

Every good thing has a great reason behind it. Know yours. Focus on it, write it out, create a vision board, and keep it in front of you at all times.

Be as specific as you can, and really think about what your goals are for the coming decades. Do you want to own and pay off your home? Get a vacation home? Plan for a family, or a bigger one?

Whatever it is – write it down on paper. If you’re married, make sure you share your goals with your spouse, and also plan goals together. After listing your goals, create a plan to get there. Revisit these goals every six months to one year to be sure you’re making progress.

3. Learn to Live Within Your Means

Living within your means is essential to financial success.

Why?

Because if you don’t learn to control your budget now, then no number of raises will ever help to fix that bad habit. Overspending limits your ability to save, invest, or prepare for hardships. The first step is to outline what your “means” is – that is, how much income you earn per month and what your expenses are.

From there, you can figure out your extra income – called disposable income – and decide how you should use it. After saving and investing, it’s wise to set aside some disposable income as ‘fun money’ so that you don’t feel deprived. You just can’t allow all your money to be fun money.

This doesn’t have to mean you never get to go on vacations or have fun. You just need to find ways you can save on things you don’t value, and feel free to spend money on the things you do value.

4. Pay Off Debt

Debt payments are often the biggest hurdle to building wealth.

Make it a priority to pay off your debts and try not to incur more. Take a look at your school loans, credit card bills, car payments, etc. Prioritizing debt paydown now will free up your available money later.

When possible, pay cash for purchases instead of credit. Pay off your credit card every month and don’t spend more than you can afford on it. Stay out of debt and you will set yourself up to build wealth and accomplish your goals much faster down the road.

5. Prioritize Saving

No matter how little discretionary income you have, you can always save. Savings should constitute a good portion of your disposable income. This will help to ease the burden of hardships, such as a medical emergency or job loss.

Be sure to work at saving a certain amount of money each month and consider setting a percentage of any surprise money – such as bonuses, tax returns, gifts – to always be automatically put aside. After paying off your debt, use that part of your disposable income to save even more.

6. Understand What Money Can and Can’t Buy You

Saving is important, but it’s not everything. Financial success is ultimately getting to use your money for what’s most important to you. So make sure that you spend your hard-earned money on what you want.

It doesn’t hurt to have a “fun” savings account where you put any extra funds into experiences that are fun for you and your family. Similarly, don’t fret too much over unexpected bills or spending extra money on a special night out. You work hard so you can enjoy the fruits of your labor.

Money can buy you experiences, but it can’t buy happiness. Make sure you strike a good balance of enjoying today while also saving for the future.

7. Don’t Go At It Alone

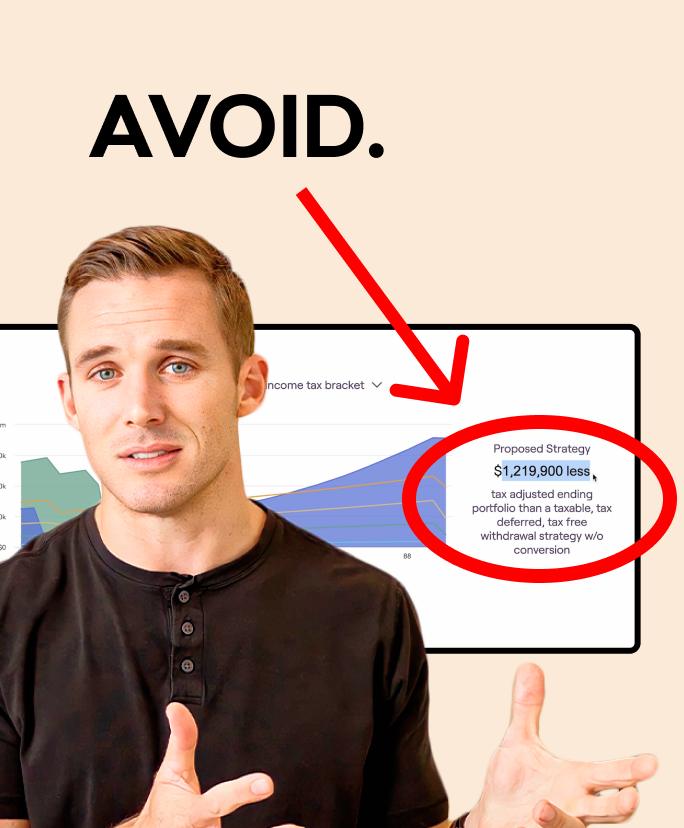

It’s tough to do everything on your own. Working with a financial planner can help.

The financial world is confusing, and it’s evolving every day.

Find a trusted financial planner and work with them to reach your goals. Schedule regular check-ins to ensure you are still financially healthy and moving in the direction of your goals.

Use these seven steps to build a financial future you can look forward to. You don’t have to earn millions to save. You don’t need to watch the stock market daily. You can start today to lay a solid financial foundation in your 30s that will benefit you for the rest of your life.