You left your job. This may be an exciting time for you or it may be the scariest time of your life!

You may be trying to figure out what your next step is to make things work out financially. In the midst of trying to land on your feet, be sure not to neglect what could be one of your biggest financial assets:

Your old 401(k).

For those trying to figure out what to do with their old 401(k) – you have options. Making the best decision with your old 401(k) starts with an understanding of the options you have available to you:

#1 Keep your 401(k) with your old company

With few exceptions, most companies will allow you to keep your old 401(k) balance in their plan when you leave. Many people end up using this option, but more often than not it’s because they don’t know their alternatives.

Pros:

- If you’re 55 or older when you leave your company then you are elligible to take a penalty-free withdrawal from your 401(k). The age is usually 59.5 for other retirement account types like IRAs.

- Your money continues to grow tax-deferred.

- Depending on the plan, you may have access to very low-cost investment options that aren’t available to you in your other accounts.

Cons:

- If you have less than $5,000 in your 401(k) when you leave then the plan might automatically distribute your balance to you or your IRA.

- Many 401(k) plans, especially those for small to medium sized business, are expensive. If you’re in one of these plans then you’re likely paying more in fees than you need to.

- You will likely have less flexibility accessing money for future distributions if it remains in your old 401(k).

#2 Roll your old 401(k) into your new company’s 401(k) plan

If your new company offers a 401(k) plan then you might be able to rollover your old 401(k) into your new plan. You won’t receive any new matching contributions on this rollover, but the rollover can be invested into the new funds and will continue growing tax-deferred.

Pros:

- Consolidating accounts helps to keep you organized financially.

- If you want to work past age 70.5, then any funds inside of your current company’s 401(k) plan aren’t subject to required minimum distribution (RMD) rules.

Cons:

- You may be more limited in your new 401(k) investment options than you would otherwise be in an IRA.

- Your new 401(k) Plan may not offer some of the same provisions or benefits as your old plan did. These include loan options, investment choices, and more. Be sure to understand your new plan provisions before doing this.

#3 Roll your old 401(k) into your IRA

If you don’t have a 401(k) plan at your new company, or if you would prefer to keep more control over your old 401(k), then you can also roll over your old account into an IRA.

401(k) deferrals are made on a pretax basis, meaning the contribution amount isn’t subject to federal or state taxes. IRAs are also pretax. So when you roll an old 401(k) into an IRA you aren’t subject to any taxes.

Pros:

- Maintain tax-deferred growth on your investment.

- You will have more investment options and flexibility in an IRA.

- You can withdraw up to $10,000 penalty-free for a qualifying first-time home purchase.

- You can make penalty-free withdrawals for qualifying higher education expenses.

- You can convert your IRA to a Roth IRA at any point if needed.

Cons:

- You can’t take a loan from an IRA.

- You may have more bankruptcy protection for assets in a 401(k) than you do in an IRA. Federal law prohibits creditors from going after funds in 401(k)s. In California, IRAs are protected from creditors up to a limit of $1 million.

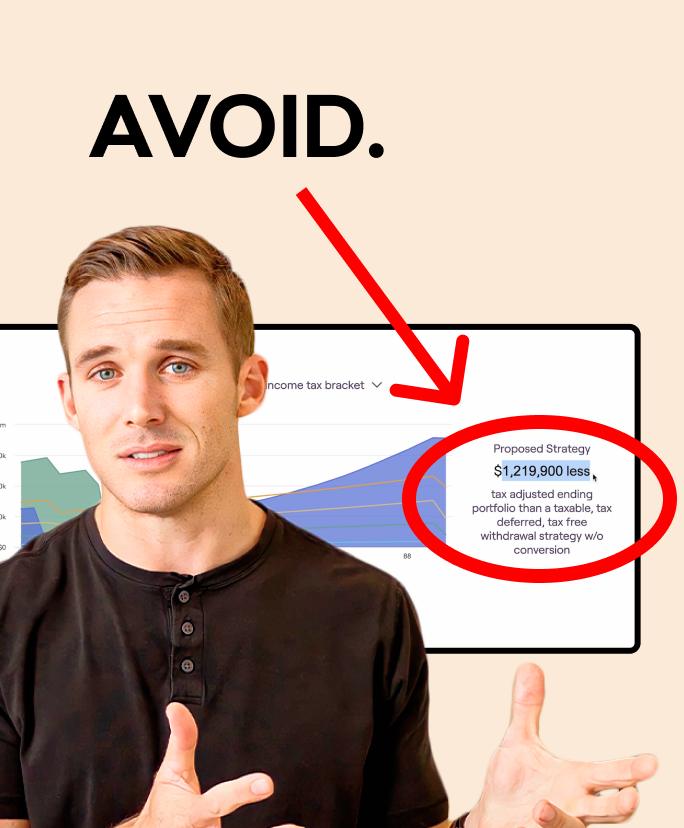

#4 Roll your old 401(k) into your Roth IRA

If you leave a job unexpectedly and don’t find work for a while, you may end up with relatively low income for the year. This could potentially be a great year to consider converting your old 401(k) to a Roth IRA.

Anything that you convert from your 401(k) to a Roth IRA is treated as ordinary income. It is subject to standard federal and state taxes. Assuming you have adequate cash saved up to pay the taxes involved, years when you have lower income tend to be better years to convert pretax accounts to Roth IRAs.

Pros:

- Depending on your income, you may be able to pay lower taxes on the conversion than you ordinarily would.

- The converted balance will grow tax-free as long as it remains in your Roth IRA.

- You will be able to make withdrawals from the Roth IRA tax free in retirement assuming you have met the Five Year Rule Requirements.

- Your Roth IRA balance isn’t subject to RMDs like your old 401(k) or IRA balance would be.

Cons:

- The converted amount is fully taxable. If you have a large 401(k) balance and you’re in a high tax bracket then you could face significant taxes.

- Be sure to speak with a tax professional and financial planner before converting your 401(k) to a Roth IRA.

#5 Cash out your 401(k)

Unless you’re already retired or in desperate need for cash, this option should likely be avoided. You will pay a 10% early distribution penalty on top of federal and state taxes if you take a premature distribution from your 401(k). Taking your distribution prior to age 59.5 is considered premature (You can take a distribution as early as age 55 if you stopped working for that employer after age 55).

Note – if you do request a cash distribution then the 401(k) provider is required to withhold at least 20% for federal taxes from the distribution.

Pros:

- You receive an immediate inflow of cash.

Cons:

- You may pay a 10% early distribution penalty on top of additional taxes for any amount withdrawn.

- Missed Growth Opportunities. Your 401(k) likely represents a big part of your future financial security. Even if you’re just getting started and don’t have a large 401(k) balance, don’t dismiss the growth potential it carries!

- Did I mention penalties and taxes?

The Bottom Line

What you do with your 401(k) matters. There are many options depending on your situation, and understanding the differences between them all can be the difference between a good decision and a bad decision.

Before you make a decision, consider speaking with a tax professional or financial advisor to ensure that you’re doing what’s best for you.